Understanding CFO Salaries

In these uncertain, post-Covid times, the survival of your company may well rest on the caliber of your CFO. The search for top CFO talent, those skilled at forecasting revenues and conserving cash balances, has grown increasingly competitive. But how do you procure the proper candidate? By creating the perfect compensation package. And understanding CFO salaries, while being well within your company’s means, will also help aggressively targets the savvy, seasoned professional. This potential candidate has the experience, vision, and leadership it takes to help your company rebuild, maintain, and expand.

Grayhawk Search is a group of Finance Executive Search specialists devoted to the exploration and acquisition of high-grade CFO talent from around the world.

Grayhawk Search is a leading Finance Executive Search professionals directly responsible for scouting and securing high-grade CFOs. We are widely recognized as a reliable authority on strategic CFO remuneration across a variety of industries,. We have extensive experience with software, manufacturing, pharmaceutical, and the telecom sector.

CFO Salaries – Considerations

Typically, CFO compensation is predicated on variety. According to cfodive.com, the average CFO compensation mix in 2019 comprised an equitable split of cash, LTI (long-term incentive) income, and equity: https://www.cfodive.com/news/compensation-ceo-pay-BDO-survey/588143/

Options and TVRS can also play an important role.

That said, all indicators suggest a growing emphasis on performance-based pay, particularly in the wake of the pandemic.

Terry Adamson, the BDO managing director quoted in the aforementioned article, adds, “CFO compensation continues to be largely based on variable or incentive pay. Because CFO pay levels are less than half (42%) of what CEOs receive, CFO salary increases tend to be higher than those of CEOs.”

Other CFO Salary considerations include:

Geography – Geographic location is a key determinant of CFO compensation. According again to chron.com, CFOs in larger U.S. cities earn salaries up to 40% higher than the national midpoint.

Industry – Industry is another principal variable in the creation of CFO compensation. As no two professional arenas are alike, CFO salaries vary widely by industry.

Size –Correlation between company size and executive compensation is another consideration. CFOs at larger companies, for instance, make more than those who manage lower revenues, while those working for public companies make up to 45% more than those employed by a same-sized private interest.

Experience – Education, experience, leadership. Such is the DNA of a model CFO. Compensation, therefore, should be carefully crafted to reflect the collective talent and experience of the candidate(s) in question. While total company revenue has the largest effect on CFO compensation, not surprisingly, the more experience your CFO candidate has, the higher the aspirational recompense.

Trends – According to capartners.com, throughout 2019, increase in CFO compensation slowed while time-based equity trended upward. Keen awareness of trends such as these positions Grayhawk as a bona fide industry insider, able to determine compensation packages commensurate with top candidate expectations. https://www.capartners.com/cap-thinking/pay-trends-spotlight-on-chief-financial-officers-2020-update/

Comparisons

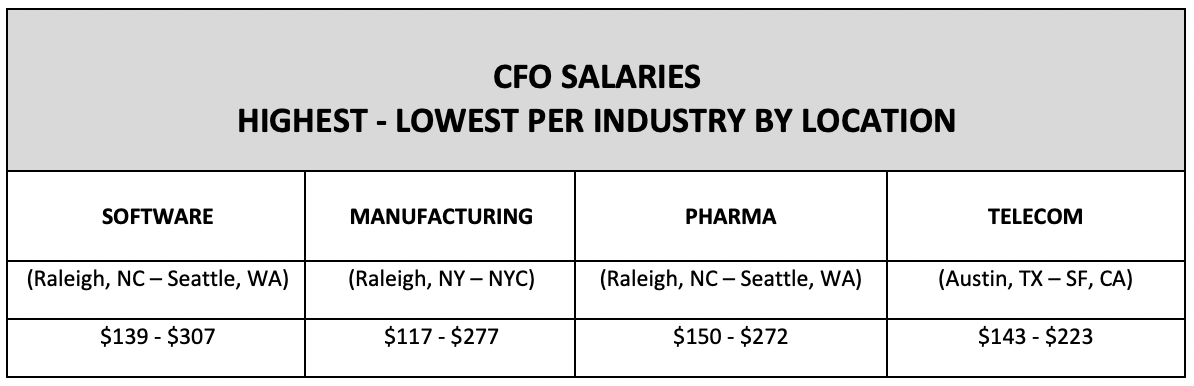

The ensuing chart shows CFO salaries and CFO salary estimates. These CFO salaries account for the aforementioned variables and are predicated on base pay. Each column represents the average CFO salary range per industry, from the lowest-paying to the highest by geographic area…

CFO Salaries: Software

Software CFOs earn more in Seattle, San Francisco, and Los Angeles than in Boston and New York. This is due, in part, to the presence of major players—Google, Microsoft, and others—in said areas. Note the fall-off in pay outside traditional tech hubs, like Raleigh, NC.

CFO Salaries: Manufacturing

While a highly qualified candidate with expert knowledge of the manufacturing industry can command competitive pay almost anywhere, the concentration of high-worth consumer brands in New York makes the Big Apple the big market.

CFO Salaries: Pharmaceutical

The rise of biotech startups and university research centers has greatly aided the geographic spread of the pharmaceutical industry, creating sizeable salaries across the board. That said, five of the top ten U.S. pharma companies are headquartered in, or are on the periphery of, New York.

CFO Salaries: Telecom

The 5G revolution, well underway, is already creating high demand for data plans, enterprise-level apps for industry, and, spawned by the pandemic, solutions for everything from telemedicine to distance education. While AT&T is headquartered in New York, the West, from Austin to San Francisco, remains an industry hotbed.

Conclusion

When it comes to determining compensation for a seasoned CFO, it pays to know those who know what to pay: Grayhawk Search.

“Forty Under 40” award winner for business & charity work, active on charity boards & committees.

Entrepreneur at heart including co-founding Grayhawk Search.

About the author:

Previously worked in Commercial Finance, Banking and Legal industries expertise focused on Corporate Finance & Strategy and M&A for Financial Services, High Tech Start-Ups, Public Finance Deals, InfoTech, BioTech, CleanTech and Alternative Energy. “Forty Under 40” award winner for business & charity work, active on charity boards & committees. Entrepreneur at heart including co-founding Grayhawk Search.