Understanding CFO Salaries

Pay for Chief Financial Officers (CFOs) has been rising, and with good reason. While all members of the C suite team are essential for success, the one whose hand is on the financial tiller is especially critical. They can put the organization upon the rocks of insolvency or steer you into fair seas. GRAYHAWK has deep experience in finding — and fairly pricing — CFOs for organizations of all sizes. Compensation has been escalating as run-ups in the stock market increased the value of stock options.

A recent study found that overall, CFOs saw increases of 3.3% in salary and 6.6% in total compensation in 2018. Those increases appear to have slowed in 2019 and total pay (bonus plus incentives) may actually stall in 2020 and 2021.

Bonuses make up an increasing share of total CFO compensation, up from a median target value of 75% of base to 80% of base in one year, while actual payouts reached 112% of target. As a consequence of this heavy reliance on bonuses, the 2020 Covid crisis could have lingering effects on total compensation for a range of C-suite players, including CFOs. Longterm stagnation of CFO compensation seems unlikely, however, as challenging times call for greater skill and acumen. Those go with experience and, in the financial field, experience comes at a cost.

This could lead to CFOs jumping ship from companies with lower immediate growth potential and heading for greener pastures in industries that are continuing to increase market share, revenues and stock price.

Finding the right CFO to navigate your financial fortunes means being able to create a compensation package that’s fair to the organization while also attractive enough to get you the best talent in a competitive marketplace. Despite the business downturn associated with the Covid pandemic, financial professionals are still in high demand as uncertain times call for extra skill in forecasting actual revenues in a dynamic environment and conserving cash balances.

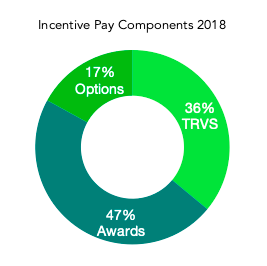

Performance awards, stock options and time-vested restricted stock (TVRS) are all part of the mix. While performance awards are still the dominant way to reward CFOs, options and TVRS play an increasing role.

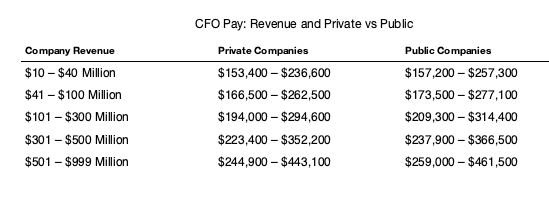

Larger Companies And Public Companies Pay More

CFOs at larger companies make more than those who manage lower revenues. And CFOs at public companies make more than their counterparts at private companies of the same size — about 45% more according to a recent survey. The experience needed to manage more money and more moving parts — as well as the increased regulatory and compliance requirements on public companies — are part of the reason.

Experience Costs

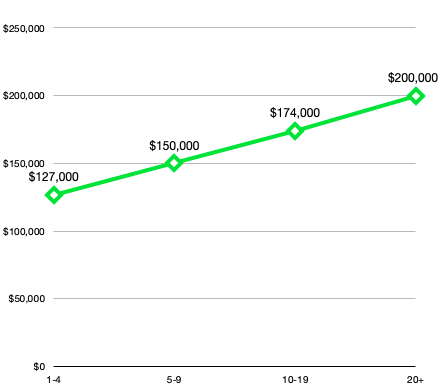

While total company revenue has the largest effect on CFO compensation, not surprisingly the more experience your CFO candidate has, the higher the compensation they expect. Especially for mid-to late-career CFOs, the lessons learned from living through multiple business cycles have prepared them to manage in a difficult environment.

CFO Pay Increases Sharply With Experience

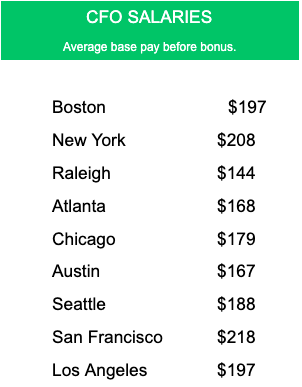

Because of the large differences in how companies structure incentive pay, and the large differences in the amount of that pay across industries and regions, we based our salary estimate tables on base pay. Whether the Covid economic downturn results in lower performance — and lower performance-based pay — over the next few years is an open question. Incentive packages for 2020 were mostly finalized before the pandemic hit, so we don’t expect to see the full impact until 2021.

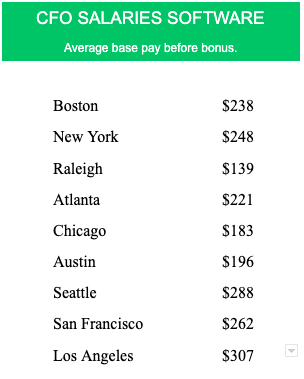

CFO Salaries: Software

Despite the continued success of the East Coast software hubs in attracting venture capital, industry CFOs actually earn more in Seattle, San Francisco and Los Angeles than in Boston and New York. This could be due in part to the presence of very large players — like Alphabet parent Google, Microsoft and others — in those markets. There is no compensation ceiling for some software CFOs, not even a glass ceiling: The CFO of Alphabet, Ruth Porat, was scheduled to earn $47 million in 2020 according to the company’s regulatory filings. Porat, who came to Alphabet from Morgan-Stanley was nominated to be Deputy Secretary of the Treasury by President Barack Obama; she withdrew her name after witnessing the brutal confirmation hearings for the man who would be her boss, Jack Lew.

There’s a distinct fall-off in pay as you get outside of the traditional tech hubs, with Raleigh, NC bringing up the rear.

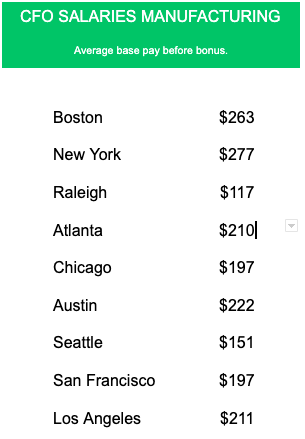

CFO Salaries: Manufacturing

While there are distinct regional differences in pay for manufacturing CFOs, the size of a company and its specific industry have the biggest influence on CFO compensation. The concentration of high-worth consumer brands in New York pushes its averages higher (and make for a more competitive market if you’re hiring): The CFO of a large cosmetics maker reported income of more than $500,000. Outside of the northeast, only Austin and Los Angeles are close to the average compensation in Boston and New York, but a highly qualified candidate with industry knowledge can command competitive pay almost anywhere.

CFO Salaries: Pharmaceutical

Sometimes it seems that the profits of pharmaceutical companies — and their stock prices — can’t go much higher. Then they do. While the political environment is uncertain — developments in the U.S. could limit future price increases — so far, the industry has barely paused to take its breath. The rise of biotech startups adjacent to university research centers has spread the industry out geographically, although five of the top ten U.S. pharma companies still have their headquarters in, or just outside of, New York. The continuing spread has brought some other pharma clusters to the fore, and with that, higher salaries for financial executives: Average salaries are actually a bit higher in Seattle and Los Angeles than in Boston and New York.

CFO Salaries: Telecom

The 5G revolution has already started, and it has the potential to transform the telecom landscape. While 5G is still very much in the building phase in North America, as it rolls out it opens the door to higher speeds and greater bandwidth. In turn, these make unlimited data plans more profitable for carriers and more convenient for consumers.

As well, 5G will make possible enterprise-level apps for specific industries. Anything that speeds up internal processes, reduces process friction or increases efficiency will sell. Telcos will likely target niches poised for new prominence in the pandemic environment: telemedicine solutions in healthcare, distance learning in education as well as manufacturing, retail, transportation and private networks.

While the opportunities for the telcos are great, so are the challenges. There will be massive amounts of capital required. When the FCC auctioned bandwidth in the 28 GHz and 24 Ghz spectrums in June 2019, telcos bid more than $2.7 billion, and overall, the industry has spent $25 billion buying spectrum in anticipation of the widespread rollout of 5G.

This massive spending is just for the right to use the airwaves. The companies now have to invest in physical plant, and then create, price and market 5G services. All of that will require CFOs who can quickly grasp the potentials and pitfalls inherent in such a large transformation.

The Right CFO At The Right Price

Given the financial unknowns and the competitive market for skilled CFOs, getting the right CFO for your organization at the right price may require outside expertise from a company like GRAYHAWK. We’ve helped scores of companies not only find a CFO, but more importantly, match CFO candidates to their exact stage of development and market position. Hiring someone from a large consumer brand will undoubtedly get you expertise, but if your organization is in an early growth stage, they may not have the kinds of experiences that will help you work through the inevitable barriers as you grow.

“Forty Under 40” award winner for business & charity work, active on charity boards & committees.

Entrepreneur at heart including co-founding Grayhawk Search.

About the author:

Previously worked in Commercial Finance, Banking and Legal industries expertise focused on Corporate Finance & Strategy and M&A for Financial Services, High Tech Start-Ups, Public Finance Deals, InfoTech, BioTech, CleanTech and Alternative Energy. “Forty Under 40” award winner for business & charity work, active on charity boards & committees. Entrepreneur at heart including co-founding Grayhawk Search.